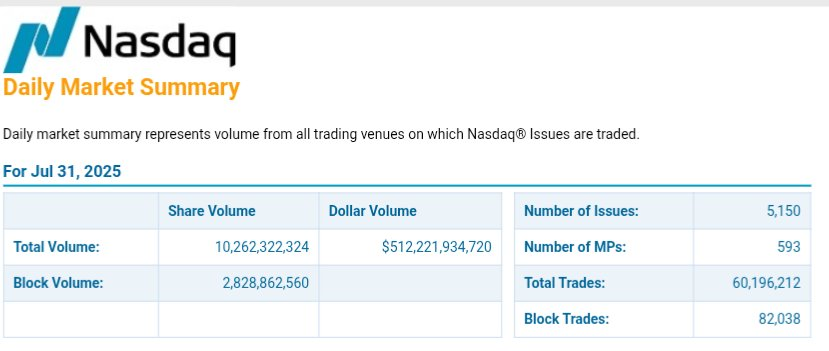

The SEC chair announces that they're bringing "all markets onchain", and people are like "Clearly, the winner in that announcement is the chain with 20 TPS", when Nasdaq alone had over 60 million trades yesterday.

We aren't a serious industry.

@0xdashoor No, it's not because your dichotomy of choice isn't correct:

I am betting on the one who literally created the policies with the SEC.

Chains = selling commoditized blockspace

Chainlink = selling data + connectivity (across all chains + non-chain networks: SWIFT, DTCC, FIX) + compute + privacy + identity, all within a single programming environment (Chainlink Runtime Environment, think of it as a virtual machine for oracle DONs), that lets you build coordinated workflows across all chains, APIs, financial networks, add in privacy, policy & compliance engines, and identity, and deploy those workflows across all chains.

Chainlink is the operating system of the new financial system.

@0xdashoor

Correct, it's not, which is my point exactly. The "biggest winner" doesn't have to be a execution layer chain nor a DA seller chain at all.

The dichotomy of choice to bet on the thesis is misframed.

DTCC's Collateral AppChain is the engine of transformation. It delivers:

• Instant settlement, reducing counterparty risk

• Real-time inventory financing, driving smarter capital allocation

• Operational resilience, maintaining continuity in volatile markets

• Automated operations, enhancing performance and user experience

This is how we scale institutional finance—with AppChain at the core.

Learn more:

@0xPeruzzi

1. That's only the Nasdaq. Not counting all the other US markets + global.

2. There's nothing that says it needs to be a public chain or a L2. See DTCC appchain (Hyperledger Besu, EVM VM with parallel tx processing)

DTCC's Collateral AppChain is the engine of transformation. It delivers:

• Instant settlement, reducing counterparty risk

• Real-time inventory financing, driving smarter capital allocation

• Operational resilience, maintaining continuity in volatile markets

• Automated operations, enhancing performance and user experience

This is how we scale institutional finance—with AppChain at the core.

Learn more:

@0xPeruzzi @cbusfritz @0xdashoor

Or the DTCC, which already serves as the current consensus layer of US markets for clearing and settlement, handling $4 quadrillion in volume, can just do it all on their permissioned Hyperledger Besu appchain (which is parallel processing EVM client).

DTCC's Collateral AppChain is the engine of transformation. It delivers:

• Instant settlement, reducing counterparty risk

• Real-time inventory financing, driving smarter capital allocation

• Operational resilience, maintaining continuity in volatile markets

• Automated operations, enhancing performance and user experience

This is how we scale institutional finance—with AppChain at the core.

Learn more:

@0xPeruzzi @cbusfritz @0xdashoor >data across many chains

>market won't be one walled garden

You're sounding like the CTO of DTCC Digital Assets!

You're agreeing with my original twet!

@Verhollj @gavin_pyott

I'm actually not talking about a chain being the biggest winner at all. If I had to pick a single chain as being the one that will process the most volume, it would be DTCC's appchain.

DTCC's Collateral AppChain is the engine of transformation. It delivers:

• Instant settlement, reducing counterparty risk

• Real-time inventory financing, driving smarter capital allocation

• Operational resilience, maintaining continuity in volatile markets

• Automated operations, enhancing performance and user experience

This is how we scale institutional finance—with AppChain at the core.

Learn more:

@DaoChemist

T+O settlement is coming. DTCC already has built a permissioned Hyperledger Besu chain (parallel processing EVM client).

"75% of RWA is happening on Ethereum" is a TVL measurement. TVL isn't a measure of fast transactions and settlement.

DTCC's Collateral AppChain is the engine of transformation. It delivers:

• Instant settlement, reducing counterparty risk

• Real-time inventory financing, driving smarter capital allocation

• Operational resilience, maintaining continuity in volatile markets

• Automated operations, enhancing performance and user experience

This is how we scale institutional finance—with AppChain at the core.

Learn more:

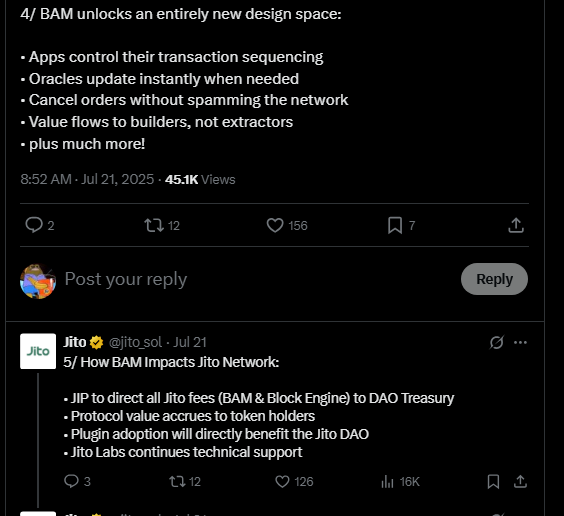

And this isn't even just an Ethereum thing. Even Solana, that still has all of its execution revenue, has margin compression on its value accrual by giving it to apps/oracles in order to retain them with this update.

L1 value accrual is going down. It's just a reality. You can adjust or cope.

PAL is LINK realized fees. It means you can pay with anything (including credit cards, ACH via SWIFT, other tokens, etc) and it becomes LINK.

"Enforced fees" is just bad UX. Furthermore, you can "enforce" on the back-end, but still have take anything on front-end. Circle did it to ETH gas fees. Users can pay USDC and it converts to ETH. Chainlink simply built it itself but much wider scope of range.

In-demand services become token value accrual.

Chainlink has more services to sell than any other protocol and is the only protocol that has every infra service within itself.

Option A) Sell blockspace

Option B:) Sell Push feeds, Pull feeds, SVR, POR with SecureMint, NAV, SmartAUM, Functions, VRF, CCIP, Privacy suite (Blockchain Privacy Manager + CCIP private transactions + DECO(zkTLS), Compliance (Automated Compliance Engine + Cross-Chain Digital Identity), all inside a programmable execution environment, CRE, that lets you build all of your workflows once and then deploy them onto every single chain.

@0xPeruzzi

Here's an example: this is MEV revenue that all used to go to Ethereum validators from selling the back-running rights to Chainlink price updates for loan liquidations.

Now it goes to Chainlink and Aave. Skate to where the puck is going, amigo.

>wild how Chainlink's narrative rests on instutional adoption

If you had good arguments, you wouldn't need to type stupid misrepresentations of mine.

Price matters, but it's not reflecting what you claim it's reflecting. It's reflecting memes and stories being sold to as many people as possible. It will eventually change, but it hasn't changed yet. I am positioning mysel for that gradual change.

Value accrual is a byproduct of protocol adoption and success.

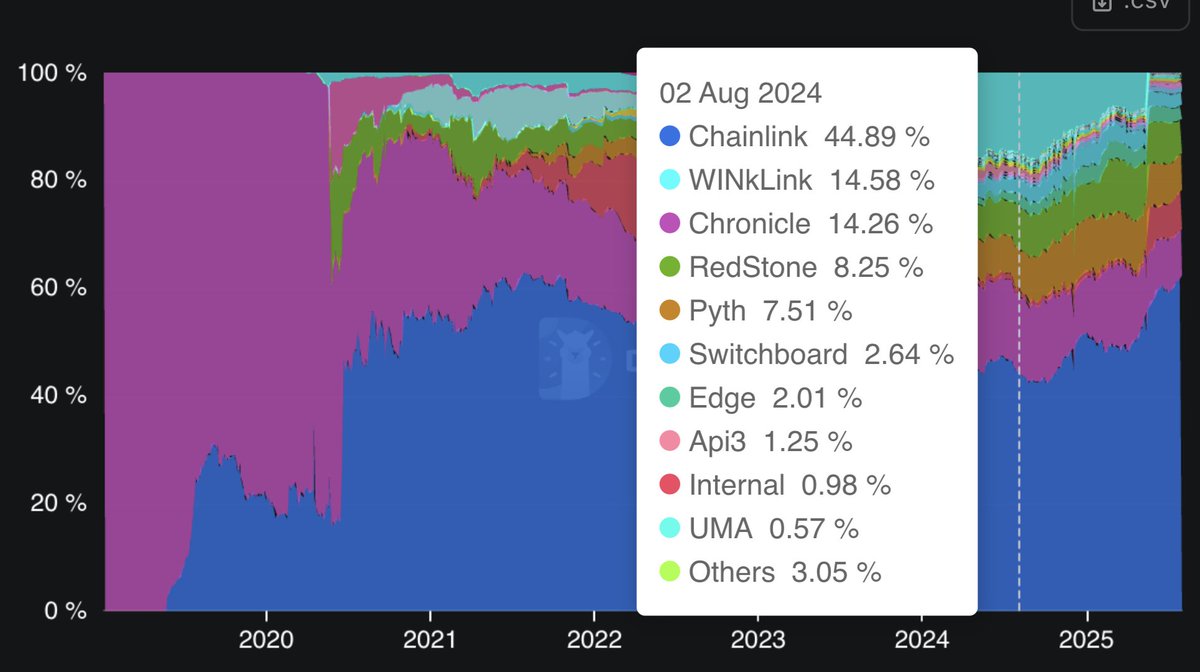

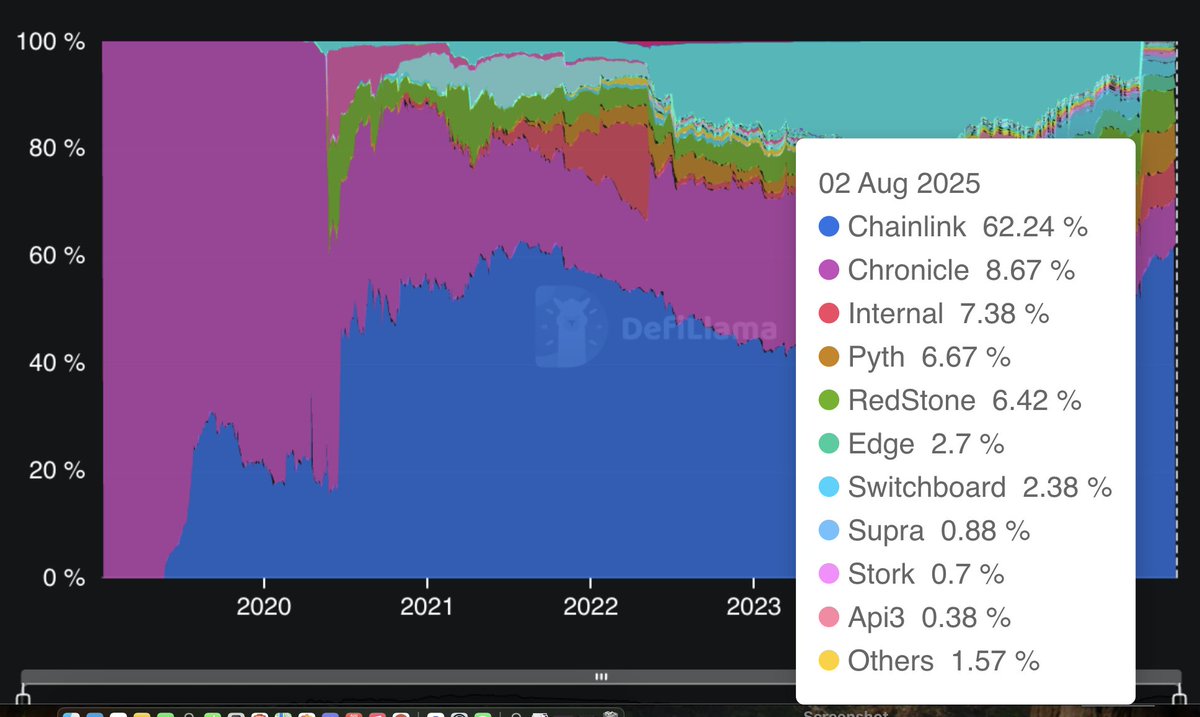

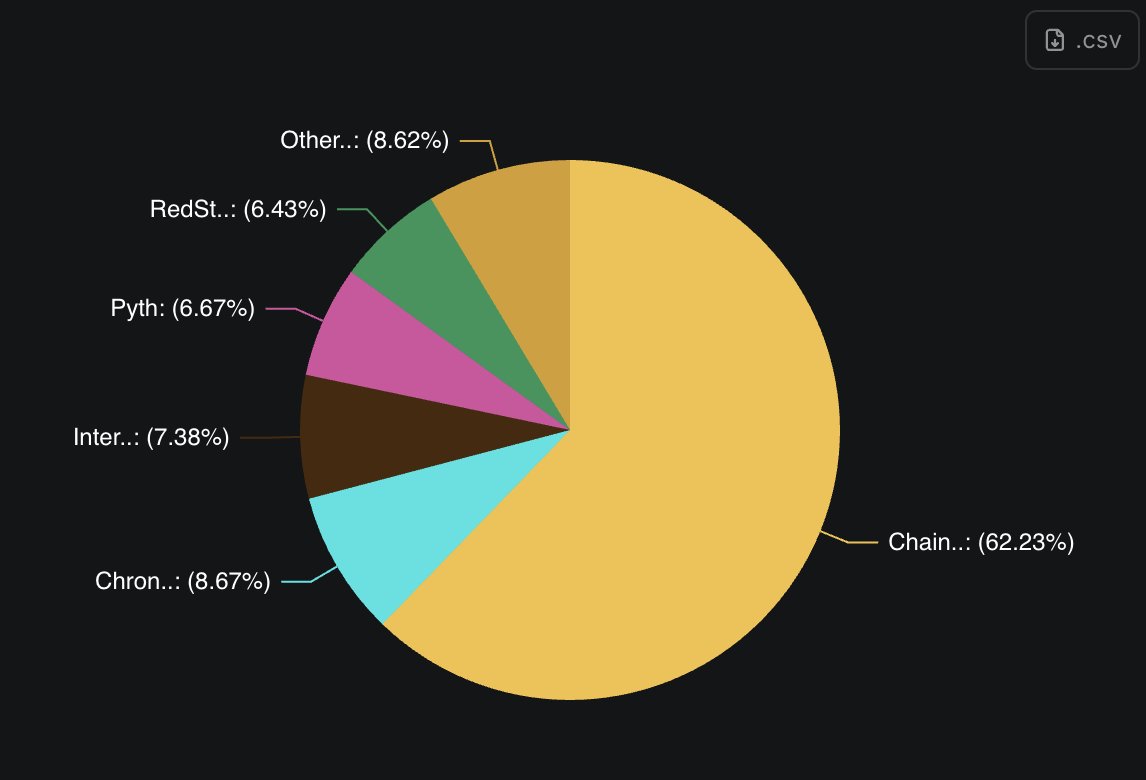

Chainlink's reality (not narrative) is that it's already the most dominant adopted protocol in crypto today (much higher marketshare where it competes than Ethereum or any blockchain), and that dominance will continue into TradFI. See the attached tweet.

59.92K

255

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.