The staked ETF assets are getting closer and closer.

Do you all remember when ETH had its ETF? At that time, it was still before the Trump era, and the SEC instructed that staking features should be excluded as a condition for approving the ETF, which is why the current ETH ETFs are launched without staking features.

Initially, I thought this might delay institutions from purchasing ETH, but ultimately, with the onset of the bull market, institutions are currently buying ETH ETFs in huge amounts even without staking.

In this regard, $INJ is making strides in various areas with the motto of being a blockchain for finance. To foster relationships with institutions, it is expanding by building connections here and there in New York, and during the time when the dApp ecosystem was stagnant, it is gradually creating opportunities for many projects to onboard by introducing MultiVM.

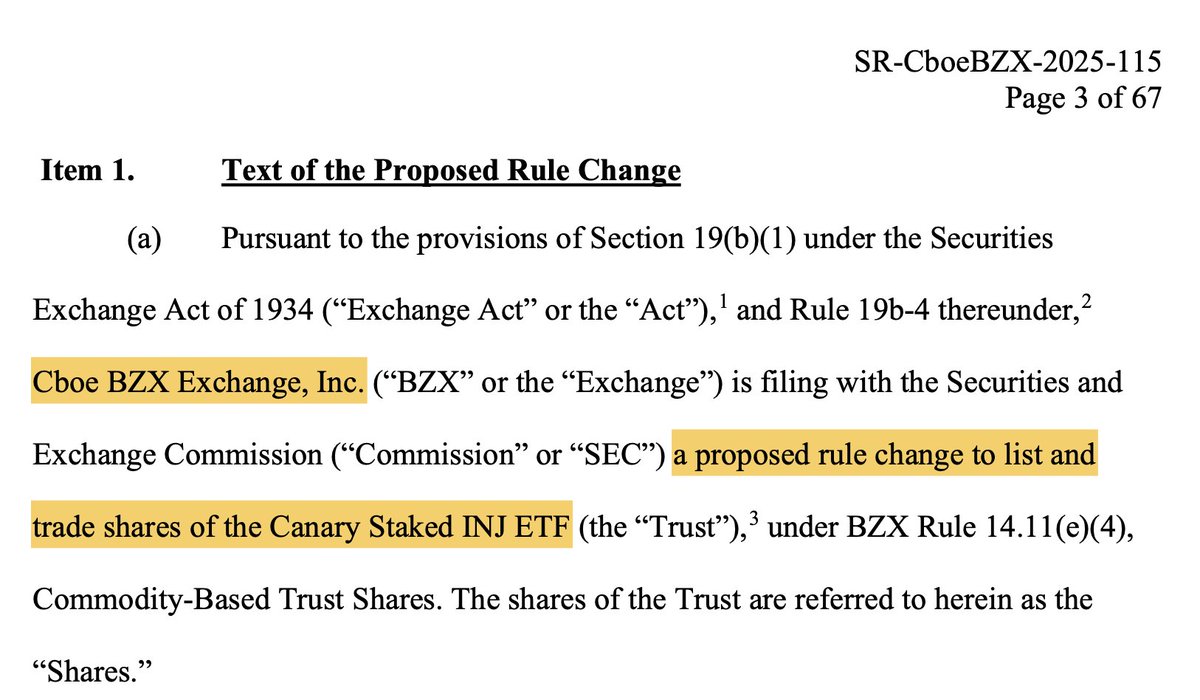

Additionally, CBOE has applied to the SEC for the Canary Capital Staked $INJ ETF, which means that @injective is preparing to apply for an ETF based on already staked INJ and sell it to institutions.

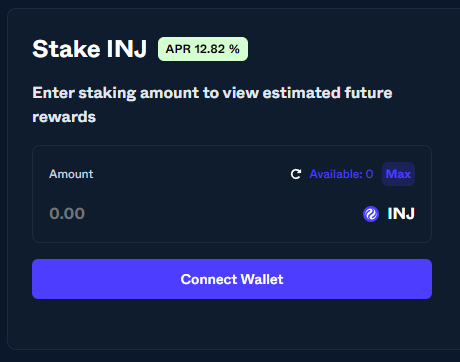

Currently, the buying pressure for INJ is not that high, but if an ETF is offered with a staking interest rate of 12%, which is higher than Ethereum's staking rate (which is at most 4-5% even when staked), we might see whether institutions will have a strong demand for staking interest despite the higher risk compared to ETH.

This has a flywheel effect; as institutional demand increases, the staking interest rate will likely decrease. Moreover, as more INJ is staked, the amount of INJ available in the market will also decrease.

This phenomenon could potentially raise the demand for LST and LRT tokens within Injective.

The CBOE has filed with the SEC to list the Canary Capital Staked $INJ ETF.

For perspective: The @CBOE US equities exchange processes over $2 trillion in monthly notional volume.

2,000,000,000,000

The institutions are here... in a very big way.

5.88K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.