🫛 Peapods Lending Cheatsheet

How to earn 20%+ APY on $USDC and 5%+ on $ETH in an automated, diversified, and insured lending vault in just 3 steps:

1️⃣ Go to 🔗

2️⃣ Select a Metavault (by chain + asset)

3️⃣ Deposit your funds

That’s it. Details below 🧵

2/ Step 1️⃣: Go to

→ Connect your wallet (top right corner)

→ View the Lending page with live APYs, TVL and vault options

3/ Step 2️⃣: Select a Metavault

→ Filter by chain and asset type (icons at the top right)

→ Compare APYs, TVL & asset type

→ Click "Supply" on the Metavault of your choice

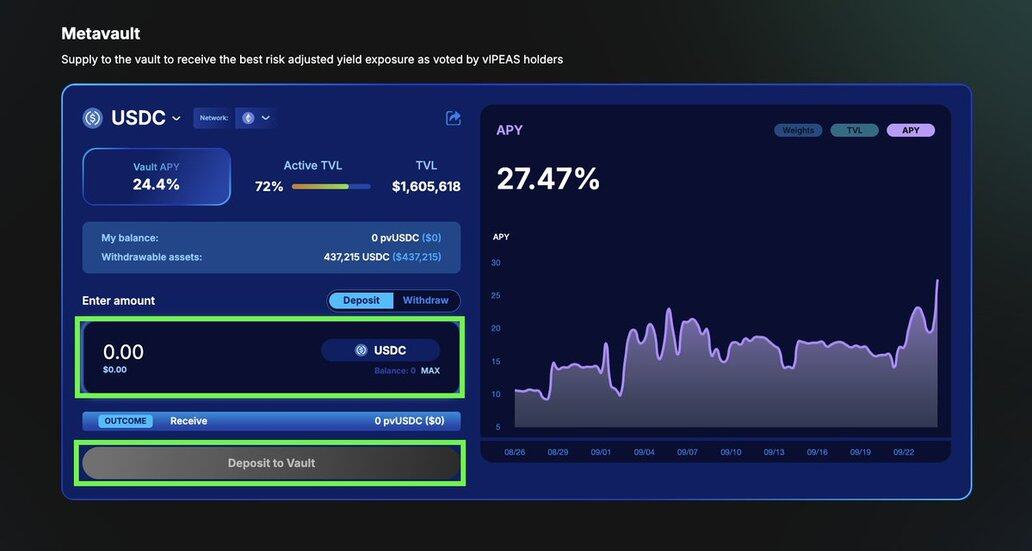

4/ Step 3️⃣: Deposit your funds

→ Enter the amount you want to lend

→ Approve the token

→ Hit "Deposit to Vault"

✅ And you're done – easy peasy!

Your funds are now earning market-leading yield with built-in diversification + insurance of the vault against bad debt up to $200K.

Read on to learn more about Metavaults on Peapods.

5/ What are Metavaults? 💡

Metavaults are aggregator vaults taking in capital from suppliers and allocating it across Pod lending pairs on the Peapods platform:

→ Capital is pooled and then diversified across Pods

→ The system auto-manages risk + yield strategies

→ Yield comes in from LVF borrowers’ interest payments

Think of Metavaults as a set-and-forget yield product.

6/ Why use Metavaults?

✅ Market-leading APYs (20%+ common for $USDC)

✅ No fees - ever!

✅ Curated, only allocates to Pods selected on risk-reward basis

✅ Diversified exposure across Pods

✅ $200K insurance fund against bad debt

✅ No loops, no active management needed

Supreme, safe yield without complexity.

7/ Who are Metavaults for?

🌱 Passive investors

→ Simple, convenient, stable but market-leading APYs

🌱 Risk-conscious lenders

→ Curated, diversified, insured

🌱 Really, anyone!

→ No lockups, no fees - who wouldn't like that?

Metavaults are designed for everyone.

8/ Checklist: When to use Metavaults?

❓Have idle $ETH or $USDC sitting around?

❓ Want passive yield with no lock-ups?

❓ Want safety built-in via diversification + insurance?

❓Want independence from market "seasons"?

Metavaults are your "All Seasons" go-to option.

Yield is driven by borrowers farming volatility, which exists in all markets

9/ Risks and Safety 🛡

Nothing ever comes without risk. In case of Metavaults:

⚠️ Smart contract + market risks apply (like all DeFi)

⚠️ Pod-level risk → an unsafe oracle that escaped Metavault curators' attention might create bad debt

BUT:

→ Metavaults diversify across Pods (so even if one Pod were to accrue bad debt, overall impact on the vault would remain limited)

→ $200K insurance fund would help cover shortfalls

→ All Pods undergo a vetting process before inclusion

→ Contracts audited by @PashovAuditGrp, @GuardianAudits, @yAuditDAO and @sherlockdefi

Built to mitigate risks, not hide them.

11/ That’s a wrap! If you found this thread useful, please like, repost and follow @PeapodsFinance for more.

5.58K

71

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.