Aevo price

in USDCheck your spelling or try another.

About Aevo

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Aevo’s price performance

Aevo on socials

Guides

Aevo on OKX Learn

Aevo FAQ

Dive deeper into Aevo

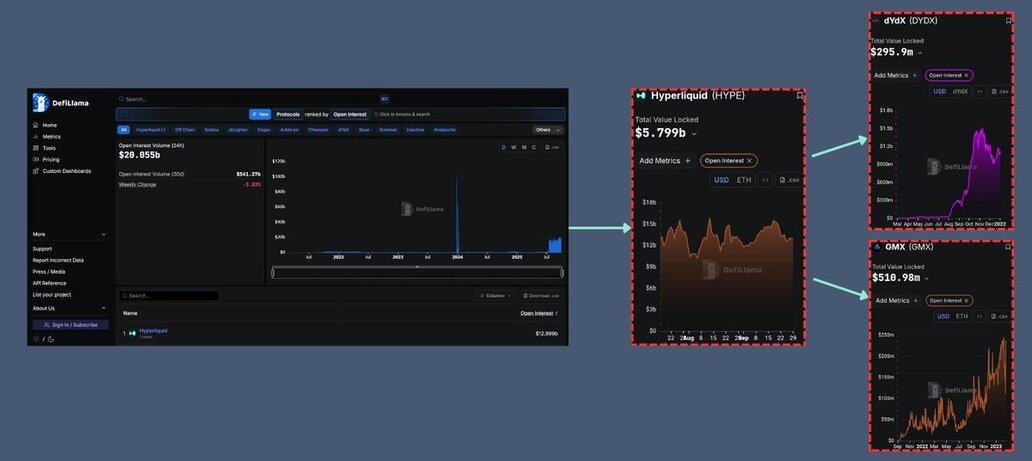

Aevo is a decentralized derivatives exchange focused on options and perpetual trading. The DEX runs on Aevo L2, an Ethereum roll-up based on the OP Stack.

How does Aevo work

Aevo Exchange is built on the Aevo L2, which is an Ethereum roll-up. The Aevo L2 is based on the OP Stack, and currently uses Conduit to run the infrastructure. Aevo L2 currently uses Celestia for Data Availability, reducing the cost for users to use the chain.

Aveo price and tokenomics

AEVO is built by the team that launched Ribbon Finance. As such, $RBN holders are able to convert their $RBN to $AEVO at a 1:1 rate, which requires a 2-month lockup.

About the team

Aevo was started by the two co-founders Julian Koh and Ken Chan. Julian and Ken were previously software engineers at Coinbase, and before that worked at crypto projects such as Zilliqa and Numerai.

Aveo highlights

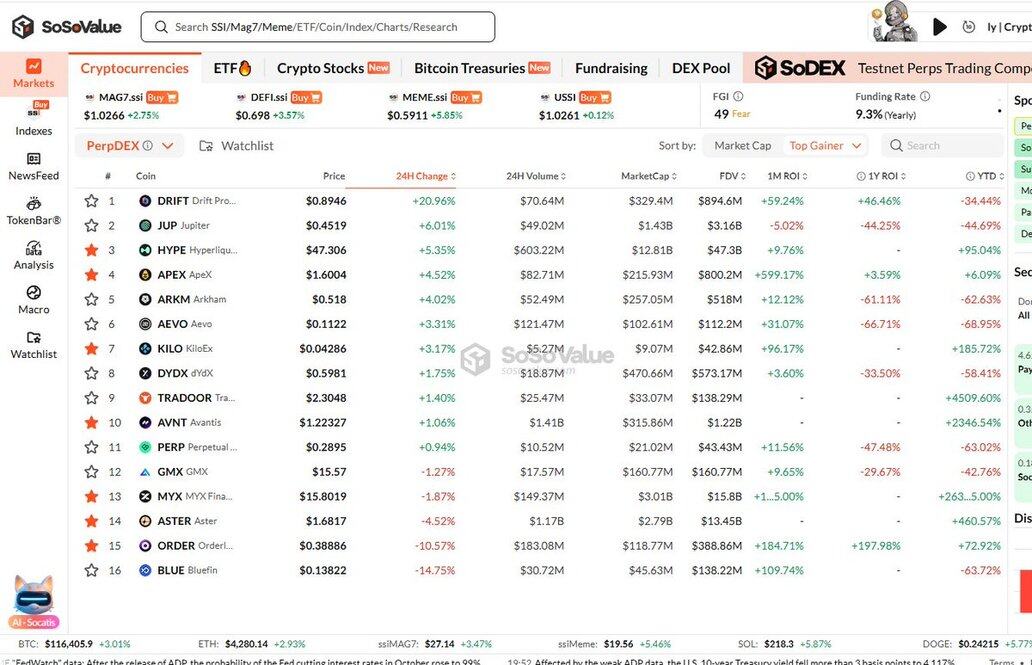

In Q1 2024, Aevo reached a high of over $5b in daily trading volume and 60k weekly active users. Aevo has over 130,000 cumulative users. Aevo is also the largest player in the Defi options, and top 3 in the DeFi Perpetuals space

Frequently Asked Questions about Aevo

- What is Aevo (AEVO)?

Aevo is a decentralized derivatives exchange focused on options and perpetual trading. The DEX runs on Aevo L2, an Ethereum roll-up based on the OP Stack.

- What are the technology features of Aevo?

Aevo Exchange is built on the Aevo L2, which is an Ethereum roll-up. The Aevo L2 is based on the OP Stack, and currently uses Conduit to run the infrastructure. Aevo L2 currently uses Celestia for Data Availability, reducing the cost for users to use the chain.

- What is the AEVO token used for?

The AEVO token governs the Aevo Exchange and Aevo L2. RBN tokenholders are able to migrate their RBN to AEVO at a 1:1 rate, with a 2 month lockup period.

ESG Disclosure