FLUID price rallies as Fluid DEX dominates stablecoin swaps across Ethereum and L2s

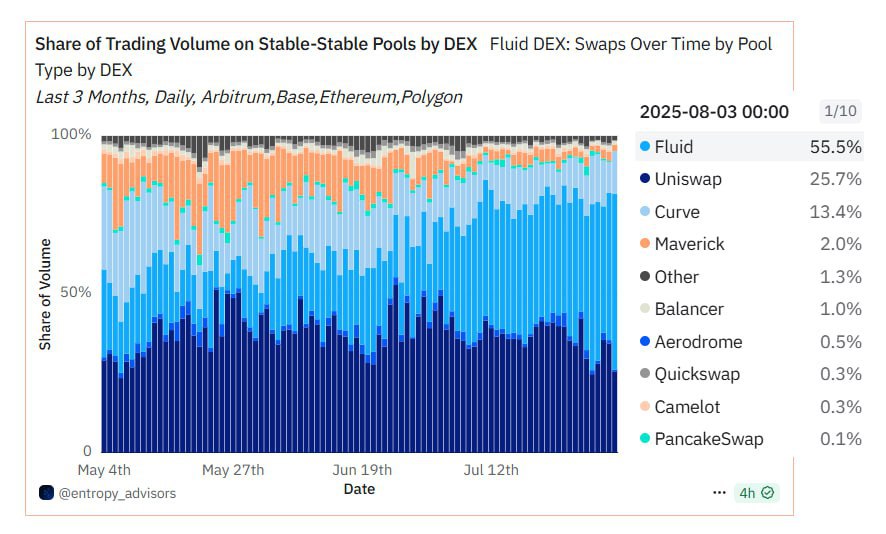

- The DEX captured 55.5% of stable-stable swap volume on Ethereum, Base, Arbitrum, and Polygon.

- Dune data shows Fluid handled more volume compared to all DEXs combined.

- FLUID tokens surged over 15% in the past day amidst investor interest.

Cryptocurrencies remain elevated today as Bitcoin reclaimed $115,000 after approaching $112,000 on Saturday.

Ethereum steadies above $3,600 as XRP regains the $3 mark.

Meanwhile, lesser-known FLUID grabbed attention with a 15% increase over the past day as Fluid DEX dominated the DeFi scene.

Fluid decentralized exchange accounted for 55.5% of stablecoin-for-stablecoin trading volume on Ethereum, Base, Arbitrum, and Polygon on August 3 (Dune Analytics data).

It outperformed established and long-time market leaders like Curve and Uniswap, and that was enough to stir the DeFi community.

For context, Uniswap captured 25.7%, whereas Curve managed 13.4% of the market share.

The protocol’s native token, FLUID, demonstrates renewed optimism with a 16.10% price rally over the past 24 hours.

Fluid climbs DeFi ranks

Indeed, the stablecoin scene has seen tremendous growth since the US regulated the segment with the GENIUS Act.

Protocols like Ethena remain in the spotlight as yield-bearing stablecoins gain traction.

Meanwhile, Fluid has dominated the vital stable-stable swap segment, maintaining steady growth in trading volumes in the last three months.

Stablecoin-to-stablecoin differ from volatile asset swaps since they power real-world utilities, including arbitrage, liquidity provision, and payments.

Fluid has performed well in this category since May, capturing a notable 55.5% share as of August 3.

What’s fueling the growth

Well, as highlighted above, the stablecoin sector has flourished since the US passed crypto bills, bringing the much-needed regulatory clarity to the digital assets industry.

Furthermore, the remarkable share indicates a platform serving its purpose.

The DEX environment remains competitive, with stablecoin users interested in reliability, fewer fees, and speed.

Fluid’s efficient routing, deep liquidity, and compatibility (especially with cost-effective L2s like Base and Arbitrum) have propelled its upside.

The FLUID decentralized exchange is becoming a go-to platform for traders transacting stablecoins like USDT, DAI, and USDC.

Most importantly, the trend signals behavior shifts in DeFi, with users preferring newer, purpose-centric platforms over legacy giants.

Will it maintain the momentum and overthrow Uniswap and Curve for good?

Transforming stablecoin liquidity?

Fluid might change power dynamics within the DeFi world if it retains the prevailing energy.

While Curve and Uniswap have defined stablecoin swapping for years, neither holds the top position at the moment.

Fluid’s rise could welcome a new era, where users prioritize performance over legacy.

Moreover, it reminds us of the benefits of stablecoin infrastructure.

While the crypto community often gravitates to narratives like NFTs, L2s, and gaming, stablecoin activity remains the backbone of DeFi.

FLUID price outlook

The native token reflected the reinvigorated optimism with notable price gains.

FLUID rallied 16% from yesterday’s $4.7199 to press time $5.48.

The surging 24-hour trading volume highlights renewed momentum, setting the stage for further FLUID rallies.

However, broad market bias remains crucial in determining the asset’s short-term performance.

A sudden selling wave would delay the upside and trigger FLUID dips, whereas continued recoveries will supercharge the alt’s rebound in the upcoming sessions.

The post FLUID price rallies as Fluid DEX dominates stablecoin swaps across Ethereum and L2s appeared first on CoinJournal.