Hey guys, the saying "the bull market doesn't say it's at the top" holds a lot of weight, especially with OKB these past couple of days. Ever since the announcement to reduce the burn to 21 million, it has nearly quadrupled in value. The most unfortunate part is that I've already missed out on its rise, which is really frustrating, so I've been looking for similar platform tokens like OKB that have buybacks or deflationary mechanisms, and I suggest checking out @MarinadeFinance's token $MNDE.

Currently, it can be purchased on exchanges like Coinbase, Gate, Kraken, etc., with a market cap of around 50 million, which is considered severely undervalued. I compared it based on several aspects:

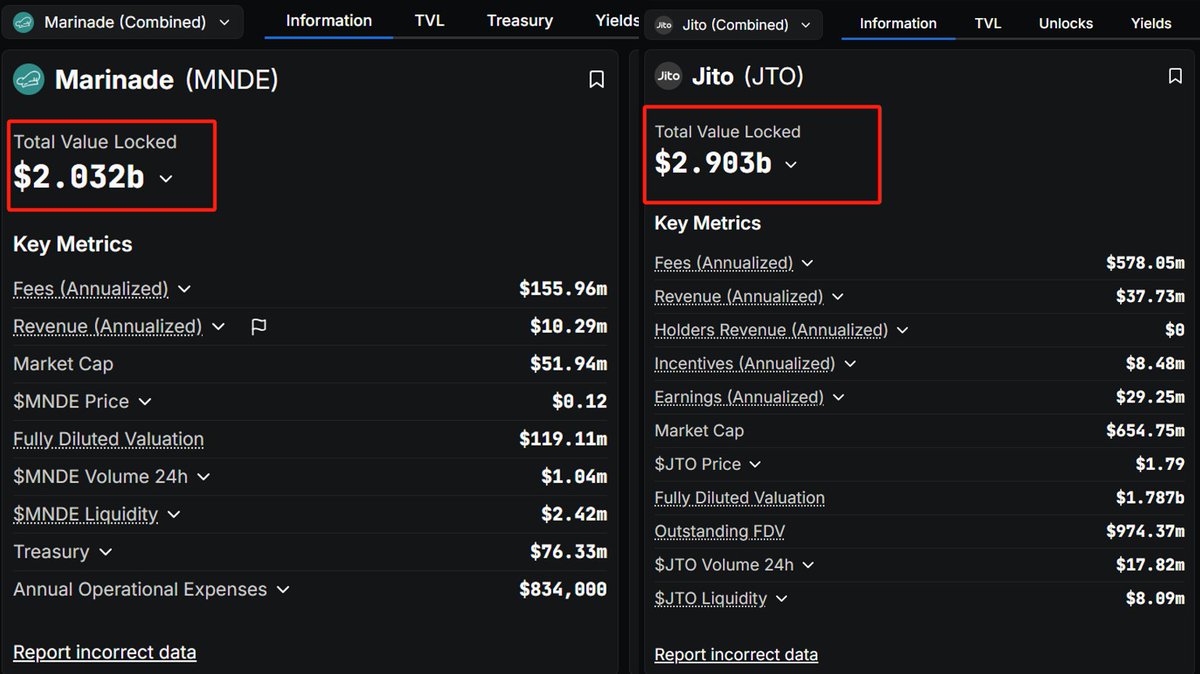

1. Marinade is the first liquid staking protocol on Solana, with a TVL of 2 billion USD. The gap between 50 million and 2 billion is indeed huge, meaning it has a lot of room to grow.

2. It is the exclusive staking provider for the US Sol ETF, and Bitgo is its compliant custodian (the narrative is online, and it belongs to a trending project with strong endorsements and compliance).

3. The Marinade team was born out of the Solana hackathon, with solid technology and a close relationship with the Solana Foundation. Moreover, major DeFi projects on Solana have integrated with it (as can be seen from the TVL funding).

4. Compared to similar projects like Jito, Jito has a TVL of 2.9 billion, only 45% more than MNDE, while the latter's circulating market cap of 655 million is over 13 times that of MNDE, indicating that MNDE has significant potential.

Having mentioned several strong advantages, let's return to the buyback and deflation plan the team is implementing. The background and resources of the Marinade project are well-known; purely from the project's profitability perspective, the annual revenue is over 10 million USD. Recently, the passing of the MIP-13 proposal means that 40% of the protocol's income allocated for buybacks has increased to 50%. This means that approximately 5 million USD worth of $MNDE tokens will be bought back each year, along with an increase in governance incentives, which, according to official news, will be implemented starting September 1st, and will be fully transparent and public. Additionally, the practice of burning 5% of the total supply has significantly reduced selling pressure.

Roughly calculating, the annual buyback of 5 million accounts for about 10% of the current market cap, which is an additional increase. The 5% burn, based on the current market cap, is about 5.9 million USD. I believe this is a substantial effort; from another perspective, the team is doing its utmost to enhance the token's value, genuinely investing resources rather than just making empty promises.

Furthermore, aside from the points mentioned above, we also need to pay attention to its incentive mechanism, with about 25 million $MNDE allocated to reward users participating in governance voting, valued at around 2.5 million currently. This not only attracts more users to participate in the project's governance but also increases the buying pressure for the token. Looking at it this way, MNDE indeed seems like a rocket that hasn't launched yet, with the team supporting it from all angles—revenue, buybacks, and ecological dividends—while the token price is still at rock bottom. Do you think $MNDE could be the next opportunity to double?

Show original

15.56K

147

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.