XRP Price Hits $3 as Ripple Outpaces BTC with $31M Inflow, What to Expect?

Key Insights:

- XRP price recovers amid $31.3 million in inflows despite the recent crypto market crash.

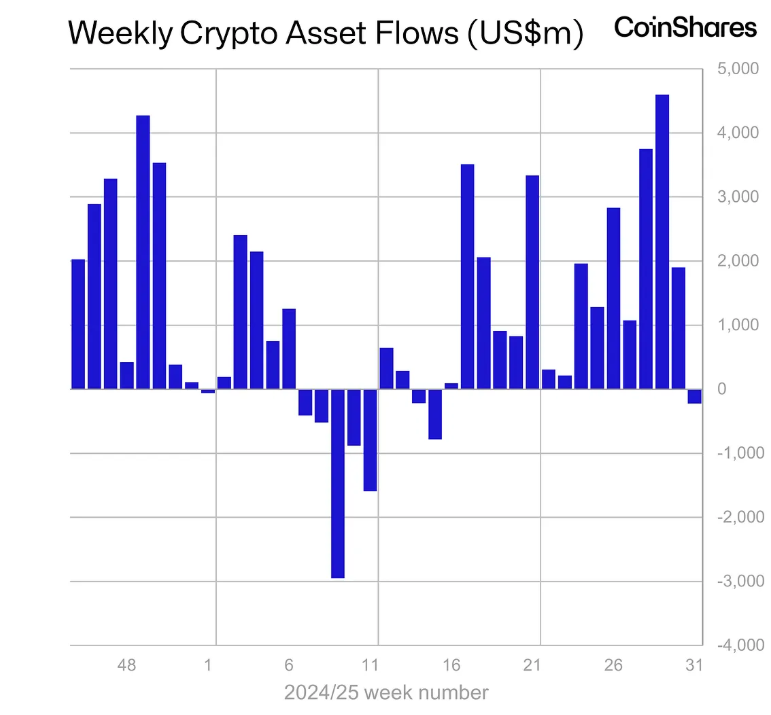

- Crypto asset investment products saw first outflow after 15 weeks.

- Ripple coin rebounded from the Fibonacci golden zone, making it a strong recovery.

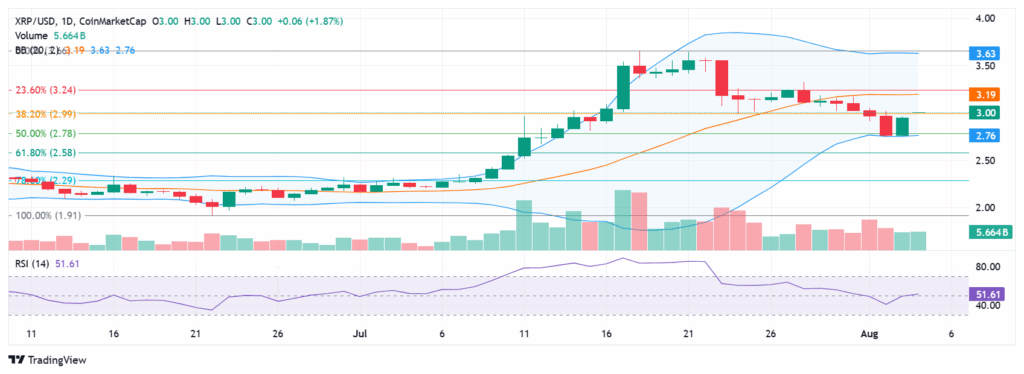

XRP price recovered strongly from the recent crash, rising almost 10% to surpass the crucial $3 level. Factors such as positive signals from technical indicators and inflow data supported the recovery.

Crypto funds recorded first outflow for the first time in 15 weeks. It indicated investors’ concerns over the approaching bull market end and hawkish Fed signals amid rising inflation.

XRP Funds Record Over $31 Million in Inflows

XRP saw $31.3 million in inflows in a week, according to CoinShares’ digital asset fund flow report on August 4. This indicated institutional demand for the crypto asset remained higher in comparison to other crypto assets.

However, the institutional interest reduced week-over-week as Ripple coin saw $189.6 million in inflow previously. The latest decline came in response to the latest crypto market crash.

The continued inflows, upcoming Ripple vs SEC case update by August 15, and ETF anticipation supported bullish sentiment in XRP price.

Crypto Funds Saw Outflows After 15 Weeks

Crypto asset investment products saw $223 million in outflows, the first outflow after 15 weeks. Interestingly, the week started with $883 million in inflows, but the hawkish US Fed and strong economic data triggered massive selloffs in the latter half of the week.

Notably, crypto funds saw $12.2 billion net inflows over the last 30 days, which represented 50% of inflows for the year. This makes the outflow comparatively smaller, with high odds of recovery from minor profit taking.

Institutional interest in Bitcoin fell for the 2nd consecutive week, recording $404 million in outflows. As The Coin Republic reported, Bitcoin saw $175 million in outflow and $2.2 billion in inflows in previous weeks.

Ethereum saw $133 million in inflows last week, indicating capital rotation to altcoins by institutional investors. ETH posted its 15th straight week of inflows, with year-to-date inflows reaching $7.9 billion.

Solana and SEI recorded $8.8 million and $5.8 million in inflows, respectively. Notably, inflows into Solana dropped from $311.5 million in an earlier week despite high odds of spot Solana ETF approval by the U.S. Securities and Exchange Commission.

Aave and Sui saw minor inflows of $1.2 million and $0.8 million, respectively. Positive flows were only recorded in Australia, Canada, Hong Kong, and Switzerland.

XRP recorded an influx of $31.3 million, extending its year-to-date (YTD) inflow to $753 million.

Why This XRP Price Recovery Is Strong?

XRP price rebound from the Fibonacci golden zone makes this a strong recovery. Investors purchased XRP after the price reached the zone in the last 24 hours.

XRP price was trading nearly 5% higher at $3 at the time of writing. The 24-hour low and high were $2.86 and $3.03, respectively.

However, it is facing resistance at $3 as the recovery came amid lower trading volumes. A 25% fall in trading volume was recorded in the last 24 hours.

If the upside move continued, the next level to watch for a further leg up is $3.34, a 38.20% Fibonacci retracement level.

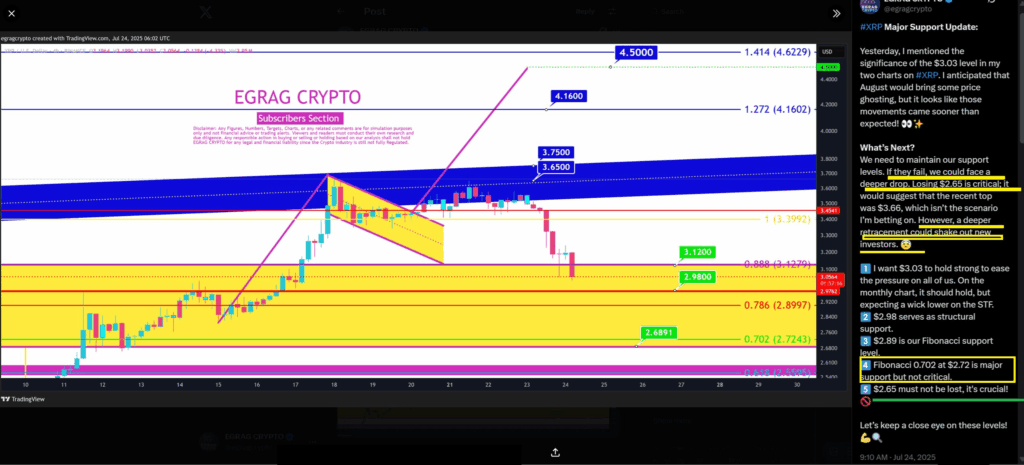

According to analyst Egrag Crypto, a close above $3.12 will negate this bearish momentum. He added that $3.03, $3.13, and $3.30 remained the next short-term targets.

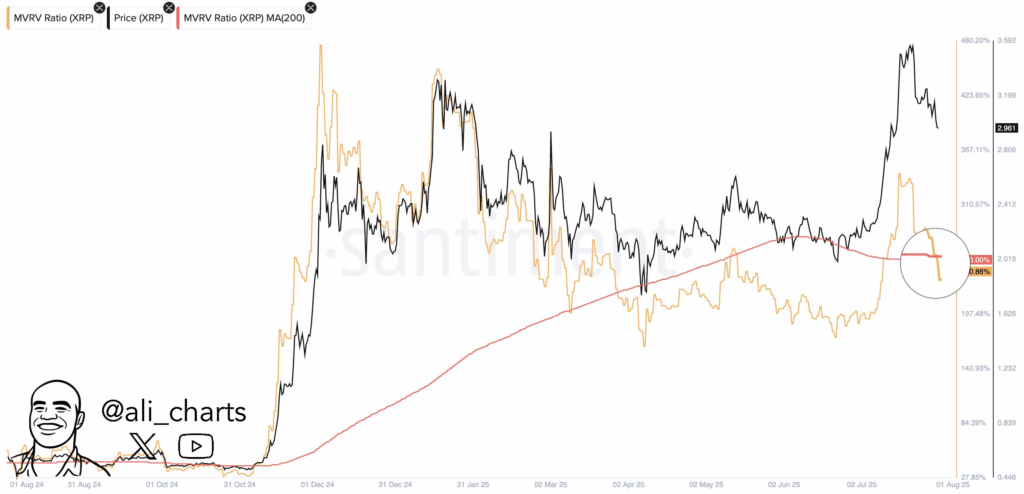

Popular analyst Ali Martinez revealed that the key concern for investors begins below $2.48, with $2.80 as a temporary buffer.

Moreover, the MVRV ratio points to a death cross formation for XRP. Investors must watch for a steeper correction if the bearish sentiment prevails.

The post XRP Price Hits $3 as Ripple Outpaces BTC with $31M Inflow, What to Expect? appeared first on The Coin Republic.